One of the most important skills that every person should learn but sadly one of the least taught in most schools and homes is personal finance. Many people struggle immensely with how they handle their money, budget their money, save and invest them, and plan for their future. This is why personal financial education is so important – it prepares students for life and offers them the support to make decisions that will allow them to achieve their financial goals.

However, how can we ensure that personal finance education is fun but effective at the same time? One of the ways is through a personal finance lab which is an integrated website that enhances competency in business, math and personal finance labs learning. With the help of the personal finance the high school students can learn by doing, rather than listening or reading. It will also help them in developing critical thinking, problem-solving and decision-making skills which are essential to develop in every domain of life.

In this blog post, we are going to give more information and details about personal finance labs, what they are, how they function, and how one can be able to play them. We shall also look at some of the benefits and characteristics of using a personal finance lab for learning and teaching personal finance.

What is a Personal Finance Lab?

A personal finance lab is, therefore, an online platform complete with a budget game and a stock market game meant to provide students with an online experience in the management of finances.

For this, a budget game is developed that proceeds to simulate life for a young adult who has to manage income and expenses at the same time having some savings and investing for his future. It pushes students to work within budget, meet bill payment deadlines, establish emergency funds, manage credit cards appropriately and handle surprises. Also, the game imparts in them a knowledge of various financial tools like debit cards, checking accounts, savings accounts, credit cards, credit scores etc.

The financial games allow college students to invest virtual money in real-time stocks, bonds, ETFs, mutual funds and even cryptocurrencies. The game helps students to learn investment research and analysis on different investments, risk diversification in their portfolio, trade through different strategies and orders, monitoring the performance, bearing the capacity of risks and how to cope with the fluctuations of the market. The game also provides the student with an option to access resulting in multiple resources such as stock quotes, charts, news, analyst ratings, calculators, and so on.

Both of the games are curriculum-linked spanning personal finance and economics, business and accounting and investing topics. Its curriculum is directly mapped in accordance to national standards and can be customized to fit the constraints of a teacher. The curriculum also integrates within it assessments to measure the students’ knowledge and skills pre- and post-playing the games.

How to Play a Personal Finance Lab?

To play a personal finance lab, you will have to sign up as a student on the platform. You will either join a class or contest already created by your teacher or some other organizer, or in case you want to play individually or along with your friends, you may create your class or contest.

Now that you have registered and logged in, you will have access to both the budget game as well as the stock market game from your dashboard. The simulation period would allow you to switch between the games at any point. You would also be able to access the curriculum as well as the assessments from your dashboard.

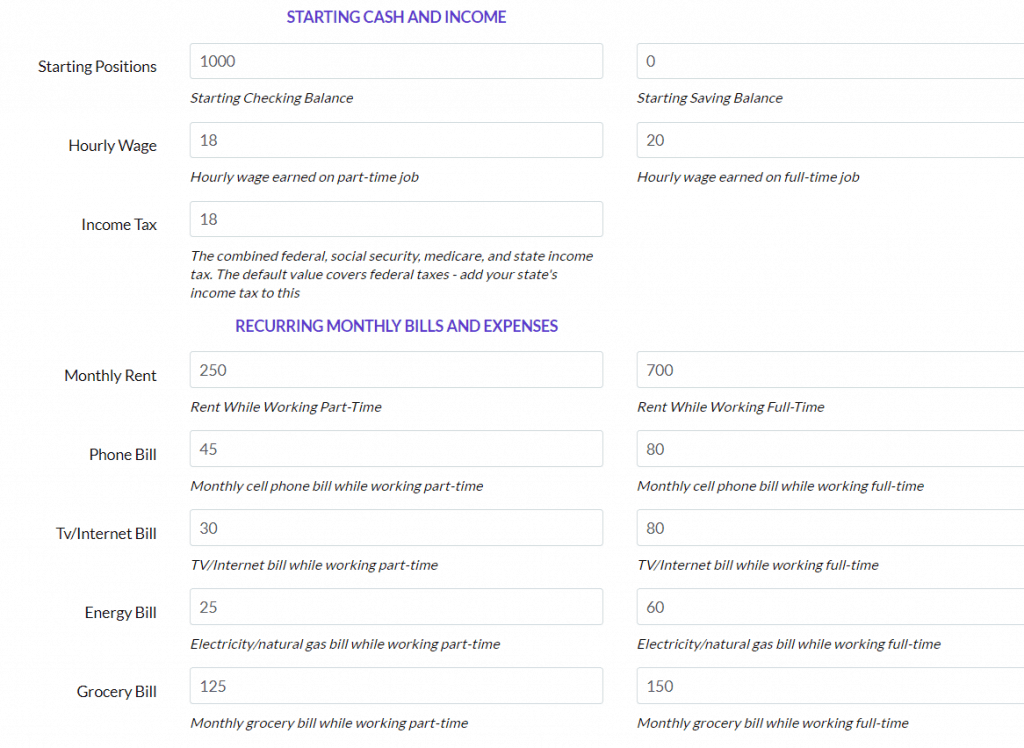

The budget game begins by placing the player into a scenario where some details about the character are given, which might include background information, income bracket, living arrangements and goals etc. Based on the scenario you need to prepare a monthly budget by dividing your income into categories of expenses like rent/mortgage utility groceries transportation entertainment etc. You also need to decide the amount you intend to save and invest every month.

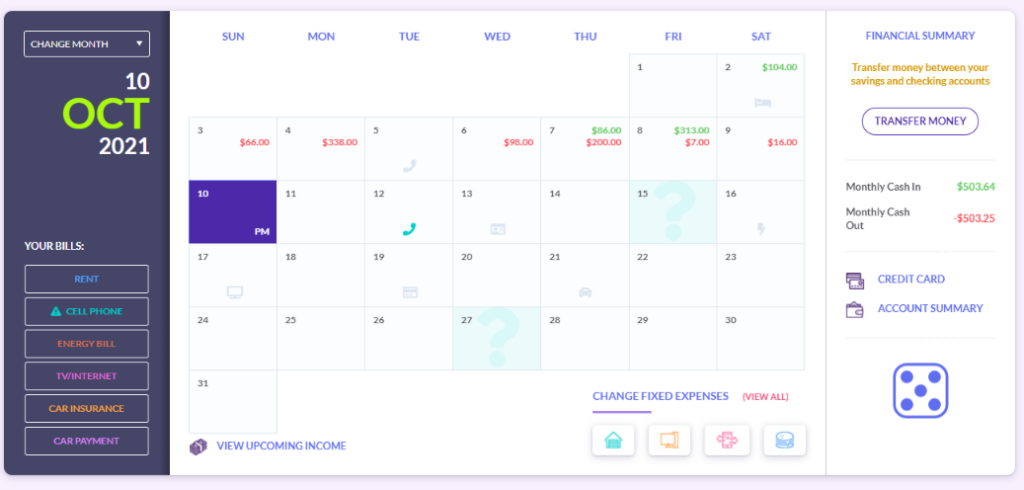

After making a budget, you need to stick to it in this simulation period of several weeks or months as it is determined by the class or contest setting. During this period, you are going to get paychecks as normal and they will be directly deposited into the checking account.

Further, you are also going to receive bills for various services availed of through debit cards and credit cards. Different events will also occur which would influence your income or your expenses as bonuses raise taxes fines emergencies etc. You will have to adapt and try to stay on the path regarding that.

The stock market game begins with a specific virtual amount of money which is credited to you as an initial sum for use in making investments along several securities like stocks bonds ETFs mutual funds cryptocurrencies etc. Choose from a broad selection of real companies and funds, with their values updated in real-time with the latest market data. You can even create your custom securities if you want to work through the various scenarios.

To be able to play the stock market game, you should research different types of securities using tools provided on the platform such as quotes charts news analyst ratings etc. You also have to define your investment strategy, either to keep the stock in your portfolio for a longer term or frequently make trades to gain short-term profits. You would also have to select the type of order you want to use such as market, limit, stop, etc., and then the duration of your order such as day, GTC, etc.

After you have placed your order it is necessary to stay abreast with monitoring your portfolio and watch how your securities perform over time. You can also monitor your ranking and compare your results with other players in your class or contest. You can of course, at any time throughout the trading hours, change or cancel your orders as well.

Both the budget game and the stock exchange are set up to be as real and challenging as possible. They will challenge you in your theoretical ideas and abilities as well as expose you to different scenarios of life situations. It will too provide feedback and directions on how you can improve your financial knowledge and behavior.

What are the Benefits and Features of a Personal Finance Lab?

A personal finance lab has many benefits and features that make it a great tool for learning and teaching personal finance. Some of them are:

- It is fun and engaging. Points badges leaderboards rewards etc. through a personal finance lab are used to infuse gamification elements and motivate students to learn and play. It has realistic scenarios and events in it where the students get the feel as if they are living through their own financial lives.

- It is experiential and interactive. With the personal finance lab, the students learn by doing as opposed to just reading or listening to a lecturing tutor. They also get the chance to interact with the personal finance platform and with other players through chat forums polls etc.

- It is customizable and flexible. A personal finance lab suite can fit any of the grade-level learning objectives curriculum standards etc. Moreover, it can also be used in any setting classroom home club etc.

- It is comprehensive and integrated. A personal finance lab encompasses a wide scope of topics in areas of education that include personal finance economics business accounting among others as well as investing. It also integrates games simulations curriculum and assessments all together in one platform to give the learners an integrated and holistic experience in the curriculum.

- It is data-driven and evidence-based. A personal finance lab incorporates real-time market data as well as historical data that ensure the delivery of accurate and relevant information to the students. It also uses reporting technologies such as data analytics whose main function is to measure the progress and performance of students as well as provide feedback and extra insights.

Here’s some lessons games are included to play, or you can do the assignments whenever it suits.

Personal Finance Lessons include:

1. Student loans

2. Compound interest

3. Investment returns

4. Building wealth

5. How to save to be a millionaire

6. Home budgeting

7. Credit card payments

8. Buy vs. Lease

9. Car loans

10. Net worth

11. Financial records

12. Keeping or tossing receipts

13. Contracts

14. Banks, credit unions, and savings and loans

15. Reconciling accounts

16. Credit cards/debit cards

17. Preparing for retirement

18. Credit reports

19. Protecting against fraud

20. Mortgages

21. Sales tax

22. Car/home/life/health insurance

23. Good debt/bad debt

24. Starting a business

25. Soooo much more!

Stock Game lessons included:

1. What is a stock?

2. Understanding stock quotes

3. Why invest?

4. Getting trading ideas

5. Trading stocks